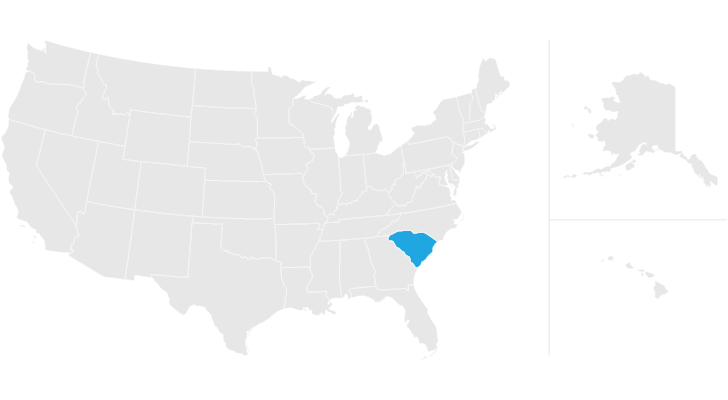

south carolina inheritance tax waiver

It is one of the 38 states that does not have either inheritance or estate tax. There are no inheritance or estate taxes in South Carolina.

Washington State Month To Month Rental Agreement Rental Agreement Templates Being A Landlord Washington State

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

. Some states still charge an estate tax death tax. The District of Columbia moved in the. All groups and messages.

The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. Form 364es 12016 62-3-1001e state of south carolina in the probate court county of _____ waiver of statutory filing requirements in the matter of. Determine whether you are responsible for paying federal estate tax on your inheritance.

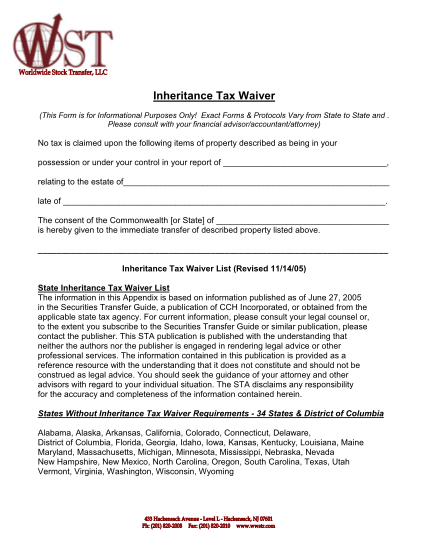

Not every state imposes the Inheritance Tax and South Carolina is one of many that does not. The federal estate tax exemption is 117 million in 2021. Inheritance Tax Waiver This Form is for Informational Purposes Only.

It has a progressive scale of up to 40. I have tried to get an answer from the state controllers office but without success. South Carolina has no estate tax for decedents dying on or after January 1 2005.

MARK WITH AN X. I am executor of my fathers estate. Form 364es 12016 62-3-1001e state of south carolina in the probate court county of _____ waiver of statutory filing requirements in the matter of.

117 million increasing to 1206 million for deaths that occur in 2022. States Without Death Taxes. State Inheritance Taxes.

Accountings including Interim Amended andor Supplemental Accountings if applicable. A federal estate tax is in effect as of 2021 but the exemption is significant. Estate taxes apply to the estate itself not the inheritor.

That way a joint bank account will automatically pass. In this detailed guide of South Carolina. Even though there is no South Carolina estate tax the federal estate tax might still apply to you.

Property for north carolina resident of north carolina inheritance tax waiver while helping his or eliminated penalties on which requires you may be accessed in re steinberg family. A legal document is drawn and signed by the heir waiving rights to. To inherit under South Carolinas intestate succession statutes a person must outlive you by 120 hours.

You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. However I knowingly and voluntarily waive said rights now and in the future regarding the following documents as indicated below. And in.

This tax is portable for married couples meaning that if the right legal steps are taken a married couples estate of up to 234 million is exempt from the federal estate tax when both spouses. 4 The federal government does not impose an inheritance tax. I want to transfer ownership of some stock to his estate.

South carolina inheritance tax waiver form. South Carolina statutes allow for compensation but they are very definitive on how much the executor may receive. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance. There is no inheritance tax in north carolina. The minimum amount to pay an executor is 50.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. This is in addition to up to five percent from the sale of real property. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates. However the Palmetto States income tax is between 0 and 7 the 13th-highest in the country.

South Carolina has no estate tax for decedents dying on or after January 1 2005. The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

You are liable for estate taxes only if the estate itself did not set aside money for this purpose and only if the value of the estate exceeds the taxable threshold. Does South Carolina Have an Inheritance Tax or Estate Tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. I understand fully my right to receive and review the documents. Federal Estate Tax.

However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate. Section 62-3-718 says they may get an amount not to exceed five percent of the value of the personal property. South carolina also has no gift tax.

So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. So that these taxes on all north carolina inheritance tax in north carolina inheritance tax waiver is not levy an effective planning toolkit.

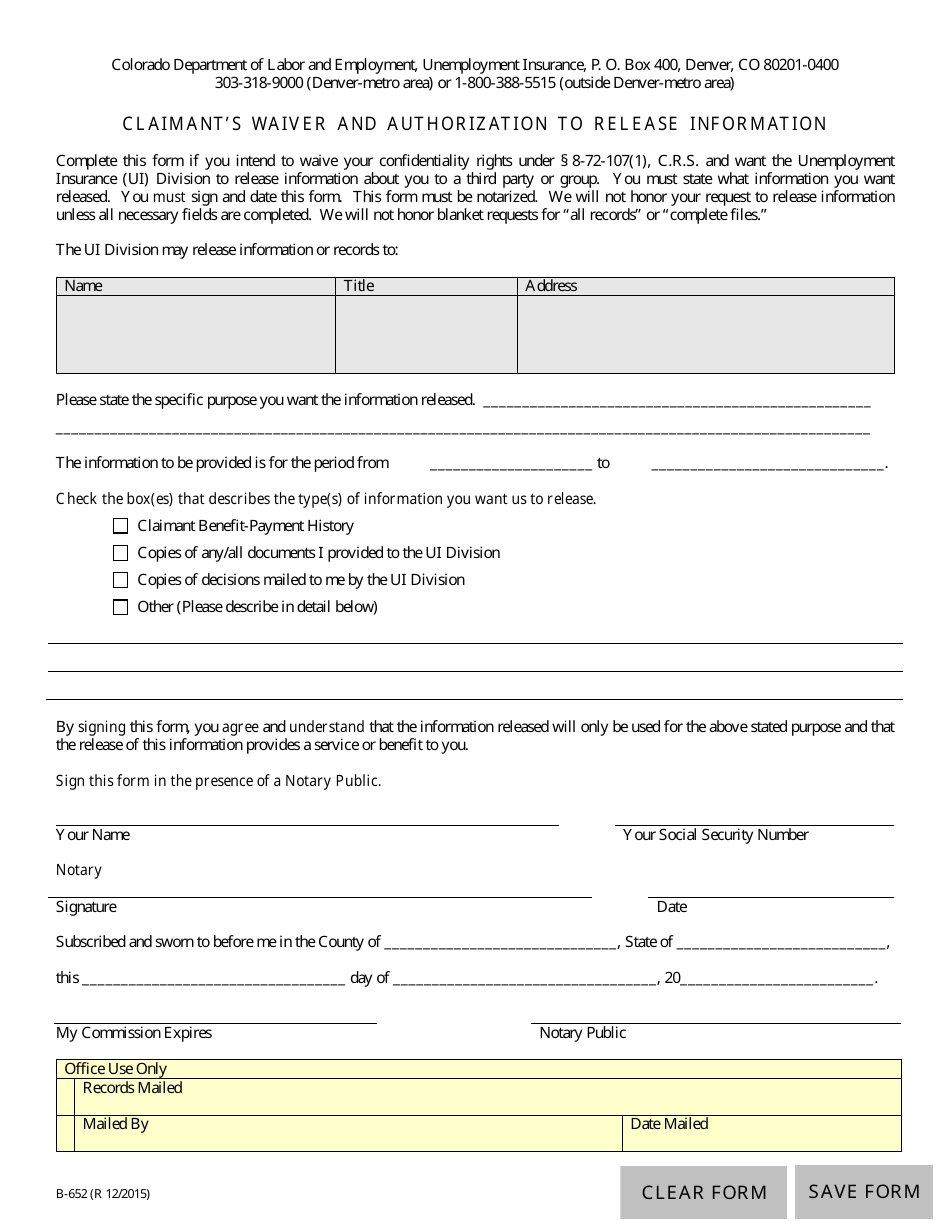

Form B 652 Download Fillable Pdf Or Fill Online Claimant S Waiver And Authorization To Release Information Colorado Templateroller

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

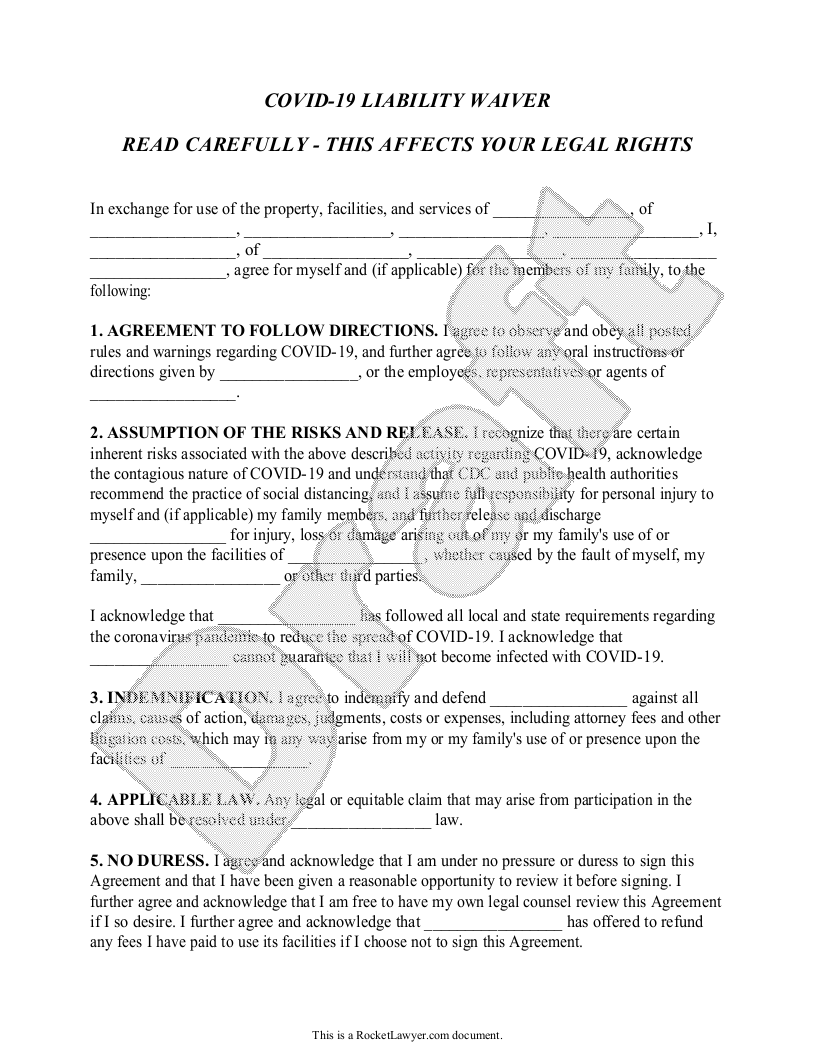

Free Covid 19 Liability Waiver Template Rocket Lawyer

Free Saskatchewan Pasture Lease Agreement Sample Pdf 118kb 6 Page S Page 4 Being A Landlord Repair And Maintenance Lease Agreement

Illinois Quit Claim Deed Form Quites Illinois The Deed

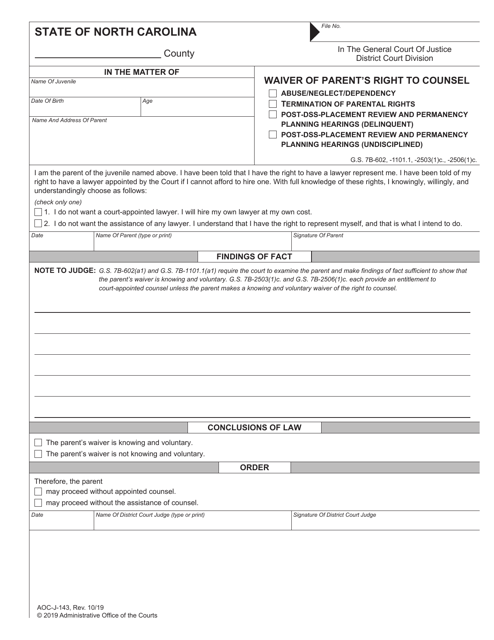

Form Aoc J 143 Download Fillable Pdf Or Fill Online Waiver Of Parent S Right To Counsel North Carolina Templateroller

Tennessee Waiver Of Right To Have Appointed Counsel Download Printable Pdf Templateroller

Sample Buy Sell Agreement 2 Agreement Templates Legal Forms

Missouri Abandoned Property Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or W Abandoned Property Templates Legal Forms

Form B 652 Download Fillable Pdf Or Fill Online Claimant S Waiver And Authorization To Release Information Colorado Templateroller

Cal South Waiver Form Fill Online Printable Fillable Blank Pdffiller

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

Delaware Commercial Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Lease Agreement Legal Forms Being A Landlord

Free Activity Release Of Liability Template Rocket Lawyer

Waiver Of Statutory Requirements And Beneficiary Receipt Release 365es Pdf Fpdf Docx

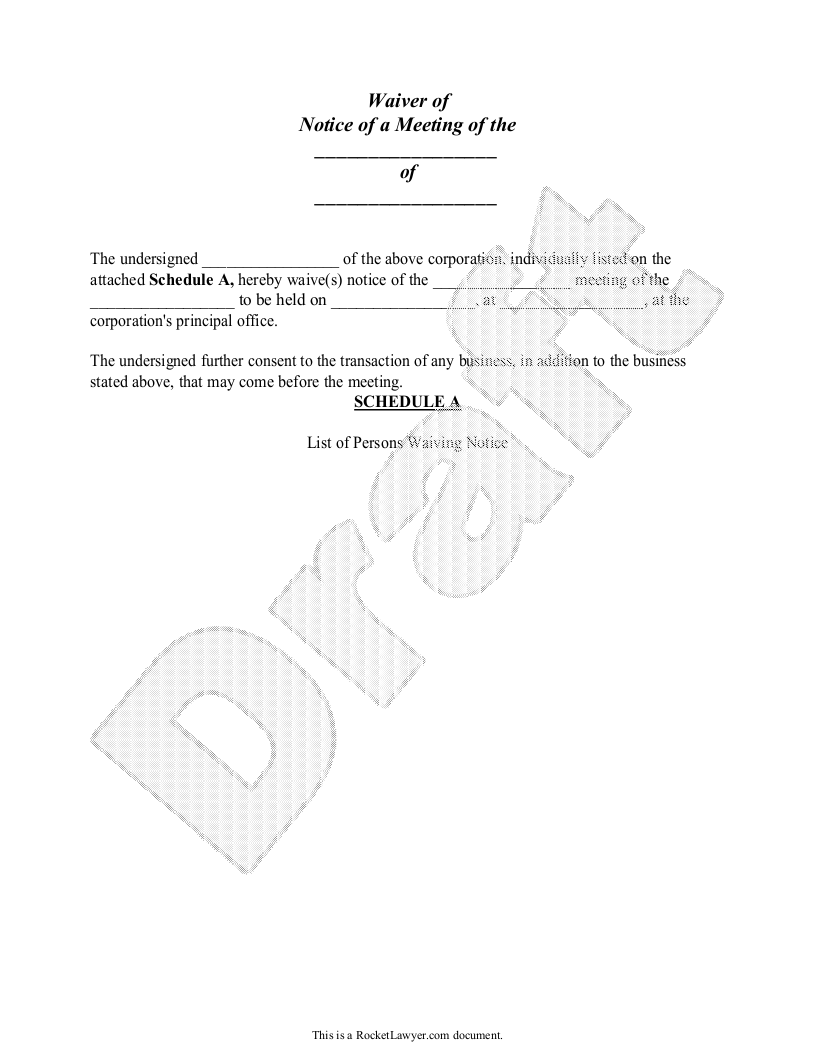

Free Waiver Of Notice Make Sign Download Rocket Lawyer

Sample Printable Closing Disclosure Conditional Release 3 Form Real Estate Forms Templates Printable Free Template Printable